|

Smart, Streamlined Checkout Experiences for the Next-Gen Guest

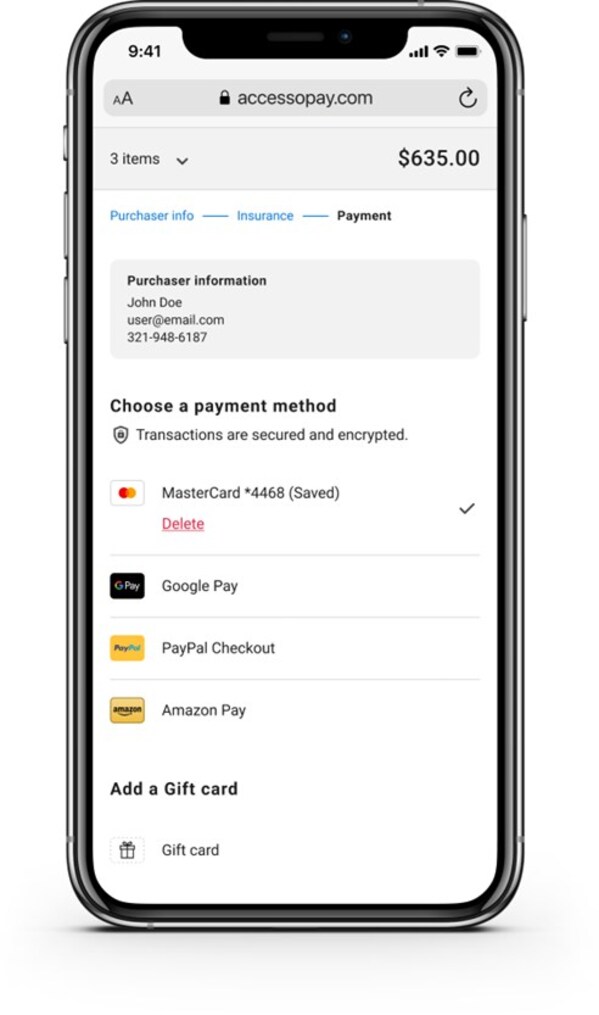

ORLANDO, Fla., Aug. 19, 2025 /PRNewswire/ — accesso Technology Group (AIM: ACSO), the premier technology solutions provider for attractions and venues worldwide, today announced the release of accessoPay 3.0, the latest evolution of its digital payment platform. Representing a pivotal step in accesso’s next-generation payment strategy, this release delivers a fully redesigned checkout experience: faster, smarter, and more secure; engineered to maximize conversion while meeting modern security and usability standards.

With a streamlined interface, refined guest journey, and robust integrations with Cybersource, part of Visa Acceptance Solutions, and with Accertify, accessoPay 3.0 empowers operators to deliver seamless eCommerce transactions, enhanced fraud protection, and greater guest confidence at every digital touchpoint.

“With AccessoPay 3.0, the team has redefined the checkout experience for attractions and venues,” said Michael Wiggins, Senior Director, Global Services, accesso. “This release is focused on creating an even smoother and more intuitive guest experience, while supporting our clients’ revenue goals through fast, smart and secure payment tools.”

Key Highlights of accessoPay 3.0:

- Revamped checkout flow and UI, with intuitive progress indicators, fewer clicks, and a streamlined user journey.

- Expanded digital wallet support, including updates to:

- Apple Pay and Google Pay, enabling fast, secure payments across supported web and mobile browsers

- PayPal, with full support for Venmo, Pay Later, and PayPal Credit

- Trustly, offering direct bank payments for select global markets; no card or app required

- Next-gen tokenization and payment security, including:

- Token Management Service (TMS) by Cybersource, built on Visa’s infrastructure to securely capture and manage card data for recurring and one-click purchases

- Network token support, boosting approval rates and reducing fraud exposure

- Integrated upselling features, including:

- Protecht Ticket Insurance, embedded at checkout

- Donation prompts to support charitable initiatives

- Flex Pay (formerly Uplift) installment loans, offer guests flexible payment options

- Enhanced fraud protection with Accertify, featuring:

- Pre- and post-authorization risk checks for real-time threat detection

- Dynamic 3DS enablement, adapting security based on transaction-level risk

- Optimized frontend architecture, including saved card functionality, dynamic payment buttons, A/B testing with Optimizely, and dynamic error handling

- Compliance-ready, supporting PCI-DSS, secure wallet storage, and adaptive authentication

As with all accesso solutions, accessoPay is designed to evolve; delivering fast, intelligent, and secure checkout experiences that meet the needs of today’s digital-first guests.

About accesso Technology Group plc

accesso is the leading global provider of patented and award-winning technology solutions that redefine the guest experience, drive increased revenue, streamline operations, and support data-driven business decisions for leisure and entertainment operators. Currently serving over 1,200 venues worldwide, accesso invests heavily in research and development to provide venues with technology that empowers unforgettable guest experiences. Staffed by a team of attractions, cultural venue, and ski industry veterans, accesso partners with venues to maximize guest engagement and revenue through intuitive ticketing, point-of-sale, virtual queuing, distribution, and experience management technologies.

accesso is a public company, listed on AIM: a market operated by the London Stock Exchange. Learn more at accesso.com or follow accesso on X (Twitter), LinkedIn and Facebook.