|

SHANGHAI, March 18, 2025 /PRNewswire/ — FinVolution Group (NYSE: FINV), a leading fintech company, today announced its unaudited financial results for 2024, highlighting continued global expansion, strategic collaborations, and advancements in AI-driven credit technology.

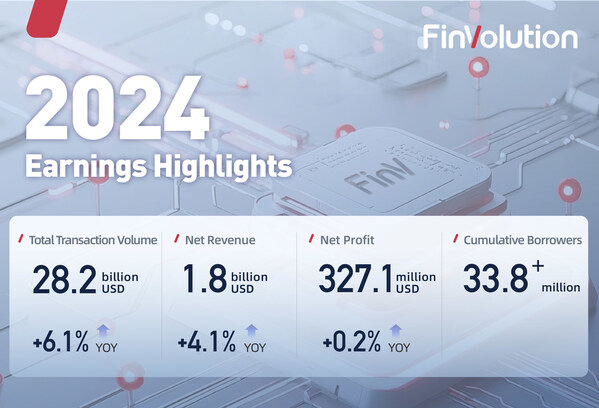

FinVolution reported annual revenue of US$1.8 billion, a 4.1% year-over-year increase, with net profit remaining stable at US$327.1 million. Transaction volume reached US$28.2 billion, up 6.1%, while outstanding loan balance rose to US$9.8 billion, also a 6.1% increase.

FinVolution Group’s CEO, Tiezheng Li commented, “We successfully leveraged our strengths in technology, customer acquisition, and retention to deliver solid results despite a challenging environment in 2024. These achievements strengthen our confidence for 2025 and beyond—becoming the leading fintech player across the Pan-Asian region.”

FinVolution Group’s CFO, Jiayuan Xu, stated: “Over the past year, FinVolution achieved solid growth and demonstrated healthy financial performance. In 2024, we allocated US$160.4 million to shareholder returns, accounting for approximately 49.1% of our annual net profit. Since 2018, we have returned a total of approximately US$765 million to our shareholders. This underscores our steadfast commitment to enhancing shareholder value and our strong confidence in the company’s business fundamentals and cash flow outlook.”

Accelerating International Growth

FinVolution’s international business continued its strong momentum, contributing 21.4% of total revenue in Q4 2024. The company acquired 2.2 million new borrowers outside of its Chinese market in 2024, a 61% year-over-year increase, with international transaction volume surpassed US$1.4 billion, while the outstanding loan balance grew 31% to US$232.9 million.

To support its global expansion, FinVolution secured key financial licenses across multiple markets, including:

- A Non-Banking Financial Company (NBFC) license from the Securities and Exchange Commission of Pakistan (SECP).

- Acquired a large majority stake in an Indonesian multi-finance company, enabling FinVolution to diversify its products into offline consumption loans with different scenarios such as mobile and electronic devices.

- Accreditation as a Special Accessing Entity (SAE) by the Credit Information Corporation (CIC) of the Philippines.

Strengthening Partnerships and Expanding Financial Inclusion

Following a successful transition to higher-quality borrowers in FinVolution’s largest overseas market, Indonesia, transaction volume in the second half of 2024 grew to US$506.9 million, up 11% compared to the first half of 2024. The company also strengthened its funding network, adding Super Bank, bringing its total active funding partners to 10 in Indonesia.

In the Philippines, FinVolution became the first company to introduce institutional funding through its loan facilitation model, collaborating with 5 leading institutional funding partners. The company also expanded its Buy Now, Pay Later (BNPL) services, embedding fintech solutions directly into major e-commerce platforms to enhance financial access for consumers.

Looking ahead, FinVolution aims to generate 50% of its revenue from international markets by 2030 under its “Local Excellence, Global Outlook” strategy. Building on its success in Indonesia and the Philippines, the company is accelerating expansion into Pakistan and other countries in 2025.

Driving Innovation with AI-Powered Credit Technology

FinVolution continues to push the boundaries of AI-driven credit technology, leveraging Large Language Models (LLMs) to optimize every stage of the credit lifecycle. In 2024, the company officially registered its proprietary LLM, “Rice Seeds”, designed to enhance credit risk assessment, fraud detection, and customer interactions.

The company also launched Zeta, an AI-powered application platform, complementing its E-LADF AI development platform introduced in 2023. These two platforms have enabled an intelligent ecosystem covering customer acquisition, risk control, and user engagement, supporting over 1,000 AI applications that have significantly improved operational efficiency and user experience:

- Customer Acquisition: AI-driven advertising technology reduced marketing material production costs by 60%.

- Risk Management: Proprietary visual AI models improved fraud detection accuracy to 99%, leveraging background template recognition and ID verification algorithms.

- Customer Engagement: AI-powered behavioral and conversational KYC tagging optimized customer service strategies, boosting overall user conversion rates by 9%.

- Customer Support: AI-generated call summaries and user sentiment analysis increased operational efficiency by 20 times.

As FinVolution continues to scale its global footprint, the company remains committed to leveraging cutting-edge AI and fintech solutions to drive financial inclusion and sustainable growth.