|

Elliott, the largest independent shareholder of Toyota Industries, believes the revised tender offer very significantly undervalues the Company and does not intend to tender its shares

LONDON, Jan. 19, 2026 /PRNewswire/ — Elliott Investment Management L.P. and Elliott Advisors (UK) Limited (“Elliott”), which advise funds that together have a significant ownership stake in Toyota Industries Corporation (“Toyota Industries” or the “Company”), today published an open letter to the Company’s shareholders.

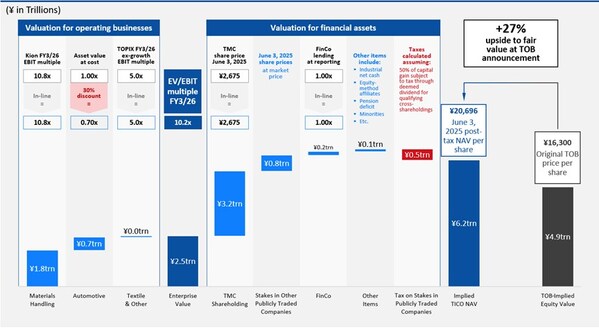

Appendix 1: Original TOB Terms Significantly Undervalued Toyota Industries at Announcement (June 3, 2025) Source: Bloomberg, Company Materials

In the letter, Elliott outlined its opposition to the revised tender offer by Toyota Fudosan Co., Ltd. at ¥18,800 per share (the “Revised TOB”), which Elliott believes very significantly undervalues Toyota Industries. Elliott’s analysis showed the Company’s intrinsic net asset value to be more than ¥26,000 per share as of January 16, 2026 – almost 40% above the Revised TOB price – and that the Standalone Plan for Toyota Industries offers a clear path to a valuation of more than ¥40,000 per share by 2028.

The letter highlighted significant deficiencies in the transaction governance process and noted that if the Revised TOB succeeds, it would represent a setback for Japan’s corporate governance reforms and dampen investor interest in the Japanese market. Elliott does not intend to tender its shares into the Revised TOB and strongly encourages other shareholders not to tender.

The full text of the letter can be read at https://elliottletters.com and is included below:

Dear Fellow Shareholders of Toyota Industries Corporation:

We write on behalf of funds advised by Elliott Investment Management L.P. and Elliott Advisors (UK) Limited (together “Elliott” or “we”) as the largest minority investor in Toyota Industries Corporation (the “Company” or “Toyota Industries”).1 Our investment reflects our strong conviction in the Company, its value and its immense potential as a standalone business.

Based on our conversations with many of you, we know that you share our concerns regarding the attempt by Toyota Fudosan Co., Ltd (“Toyota Fudosan”) to squeeze out minority shareholders of Toyota Industries at a deeply discounted and unfair valuation in a coercive transaction. Although Toyota Fudosan’s revised tender offer bid at ¥18,800 per share (the “Revised TOB”) acknowledges the inadequacy of the original transaction terms, the new price continues to very substantially undervalue Toyota Industries, whose intrinsic net asset value is ¥26,134 per share or almost 40% above the Revised TOB price. If successful, the Revised TOB would represent a major setback for corporate governance, minority shareholder rights and fair M&A in Japan. Elliott opposes the Revised TOB as it is not in the best interests of minority shareholders and because we believe substantially more value can be generated by pursuing the Standalone Plan for the Company (described below) than by tendering into this wholly inadequate offer.

Elliott does not intend to tender its shares into the Revised TOB and we strongly encourage other shareholders not to tender.

Key Takeaways

Elliott has followed Toyota Industries for many years and has invested significant time and resources in underwriting its investment in the Company. We have worked with leading commercial consulting firms, former employees, industry executives, asset valuation experts, tax advisors, law firms and accountants to form our views on the Company’s business and significant financial assets.

Our conclusions are as follows:

- Toyota Industries owns world-class, market-leading businesses that are dominant in their respective areas, are exposed to positive secular tailwinds and have tremendous growth potential. These include the Company’s materials handling business, which is a global market leader and well positioned for future growth;

- Beyond its best-in-class operating businesses, Toyota Industries holds valuable minority stakes in publicly traded companies that together are worth more than the entire market capitalization at the Revised TOB price and account for two-thirds of the intrinsic net asset value (“NAV”) of Toyota Industries;

- The initial tender offer bid pre-announced on June 3, 2025 (the “Original TOB”) significantly undervalued Toyota Industries at ¥16,300 per share;

- Since the Original TOB was pre-announced, the value of Toyota Industries’ stakes in publicly traded companies has increased by more than 40% and its closest operating peer has appreciated by over 50% – yet the Revised TOB captures only a fraction of this increase, widening the gap to fair value;

- The transaction governance process remains deeply flawed, with deficiencies in the Original TOB only superficially addressed in the Revised TOB, representing a setback for corporate governance reform in Japan; and

- The Standalone Plan (described below) offers a clear path to NAV of more than ¥40,000 per share by 2028 – more than double the Revised TOB price.

A Fork in the Road for Toyota Industries Shareholders

The Revised TOB presents Toyota Industries shareholders with a choice that will determine the future of the Company. It is also a test of the effectiveness and credibility of Japanese corporate governance more broadly.

For more than a decade, Japanese policymakers, regulators and market participants have worked to improve the governance standards of the country’s world-class businesses and capital markets. The METI Fair M&A Guidelines2, the Guidelines for Corporate Takeovers3, the Code of Corporate Conduct in the Securities Listing Regulation4, and the broader effort to promote fair M&A practices are meant to protect shareholders in situations precisely like this one. The question now is whether those protections have substance – or whether, when tested, powerful companies like Toyota Industries can forcibly squeeze out their minority shareholders at a fraction of the investment’s fair value.

If a transaction on these terms is permitted to proceed – at a price representing a significant discount to fair value, through a process with structural conflicts, and over the objections of a broad coalition of institutional shareholders – it will send a discouraging signal about the effectiveness of Japan’s vital governance reforms and set a dangerous precedent for shareholders in other Japanese companies. The credibility of the Toyota Group and Japan’s capital markets are at stake. If, on the other hand, shareholders reject an inadequate offer and the Company pursues a path that maximizes value for all stakeholders, it will demonstrate that Japan’s governance modernization is real.

We believe this is a decisive moment. As the largest non-conflicted minority investor in Toyota Industries, we face a clear choice: accept an inadequate price, or decline to tender and retain ownership in a world-class industrial and materials handling business capable of delivering substantially greater value. Elliott is committed to the latter – and we believe it represents the better outcome for long-term shareholder value.

Significant Undervaluation from the Start

When the Original TOB at ¥16,300 per share was pre-announced on June 3, 2025, our valuation analysis showed Toyota Industries’ NAV to be ¥20,696 per share (see Appendix 1). Due to the Company’s opaque disclosures, we were not able to reconcile the significant gap between the Original TOB price and the Company’s true intrinsic value, but we suspect the key factors were some combination of:

- A discount applied to Toyota Industries’ stakes in publicly traded companies, which have a visible and known price and therefore cannot plausibly be undervalued in any offer;

- An inappropriately low valuation of the Company’s best-in-class operating businesses, including the world’s leading materials handling business; and

- No value given to the substantial tax savings available when unwinding cross-shareholdings through issuer buybacks. This structure benefits from a favorable deemed dividend treatment that Toyota Industries can utilize – and which it indeed envisages will be utilized, as part of both the Original and Revised TOB plans.

There was overwhelming consensus among market participants that the Original TOB was, at the time, fundamentally undervaluing Toyota Industries – evidenced by the share price trading 13% above the Original TOB price on the trading day before the pre-announcement. In our assessment, Toyota Industries’ NAV on June 3, 2025 – before any of the subsequent appreciation – was ¥20,696 per share, representing a 27% premium to the Original TOB price and a 10% premium to the Revised TOB price.

The Undervaluation Has Only Widened

Since the Original TOB was pre-announced, Toyota Industries’ intrinsic value has materially increased. Our analysis shows NAV of ¥26,134 per share on January 16, 2026 (see Appendix 2). Toyota Industries’ NAV has risen by ¥5,438 per share since the Original TOB, while the Revised TOB represents an increase of only ¥2,500 per share (see Appendix 3).

The key drivers of the demonstrable increase in NAV from June 3, 2025 to January 16, 2026 include:

- An increase in the value of Toyota Industries’ stakes in publicly traded companies. These stakes have increased in value by more than 40%, or ¥5,720 per share before tax. Net of tax, the value of these stakes has increased by ¥4,805 per share since the Original TOB was pre-announced; 5

- An increase in the market valuation of Toyota Industries’ core operating businesses. KION Group AG (“Kion”) is the most relevant peer company, given its number-two position in the global materials handling market. Kion’s share price increased by more than 50% between the Original TOB and the Revised TOB; and

- Cash generation by Toyota Industries, as well as other changes in assets and liabilities at the Company during this time period as customary in a NAV analysis, net of the settlement of the emissions-related class action lawsuit in the U.S.

In this context, the Revised TOB is wholly inadequate. The significant undervaluation evident at the time of the Original TOB pre-announcement on June 3, 2025 has not been addressed, nor will minority shareholders participate in the indisputable increase in the value of Toyota Industries’ stakes in publicly traded companies or in the market value of the Company’s operating businesses since the Original TOB.

The disconnect is evident from the final negotiations over the Revised TOB:

- On January 9, 2026, in response to a proposed offer price of ¥18,600, it was deemed that the price “still significantly deviates from the price level envisioned by the Company’s board of directors and the Special Committee, and must be largely increased also from the perspective of securing minority shareholders…in light of the fact that there is an increasing trend in the share prices of TMC and the Three Toyota Group Companies owned by the Company, the Tender Offer Price must be proposed factoring in the risk of price fluctuations up to the scheduled announcement date of commencement of the Tender Offer…”.6

- The Special Committee urged Toyota Fudosan to “substantially increase” the proposed offer price accordingly, acknowledging both the inadequacy of ¥18,600 and the rising value of the Company’s stakes in publicly traded companies.

- On January 12, 2026, Toyota Industries received the final Revised TOB price of ¥18,800 per share from Toyota Fudosan. On January 13, 2026, just one day after the proposal was received, Toyota Motor Corporation’s share price rose by 7.5% and the Company’s other stakes in publicly traded companies also increased in value. This rise resulted in a ¥1,005 per share increase in the post-tax intrinsic value of Toyota Industries – an increase which should have been fully accounted for in a further revised TOB price, but which was not.

- Despite the foregoing, on January 14, 2026, the Company accepted and recommended the Revised TOB price of ¥18,800 – just a cosmetic ¥200 more than the price which, days before, the Company had said deviated significantly from its expectations and needed to be substantially increased to safeguard minority shareholder interests – even before the increase in value of the Company’s stakes in publicly traded companies on January 13, 2026.

This example demonstrates that intrinsic value growth from Toyota Industries’ stakes in publicly traded companies has not been appropriately captured in the price negotiation process. It is therefore unsurprising that Toyota Industries’ representatives, at the January 14, 2026 press conference, were unable to explain how the significant increase in the value of the Company’s publicly traded stakes since the Original TOB announcement had been reflected in the Revised TOB price.

The deficiencies in the Revised TOB price are also evident from the shockingly low implied valuation under other methodologies:

- Less than 1x estimated book value: The Revised TOB price is materially below our estimate of IFRS book value as of December 31, 2025 (see Appendix 4). It is even further below our pro forma estimate of book value as of today, given the subsequent material increase in value of Toyota Industries’ stakes in publicly traded companies and in the overall Japanese stock market.

- Less than 1x EBITDA for the core operating business: At the Revised TOB price, Toyota Fudosan would effectively be acquiring the core operating business at a valuation of less than 1x EBITDA (see Appendix 5), resulting in ¥2.2 trillion of value accruing to Toyota Fudosan that instead should accrue to Toyota Industries’ shareholders.

The market appears to share our assessment. Toyota Industries’ shares have traded above the Revised TOB price since the January 14, 2026 announcement, indicating continued investor dissatisfaction with the transaction terms.

A Coercive Transaction

The fundamental conflicts and inherent coercion that arise from the Revised TOB and network of interconnected Toyota Group transactions call for enhanced transparency and adherence to the fundamental protections and fairness measures for minority shareholders. These are enshrined in the Fair M&A Guidelines, the Guidelines for Corporate Takeovers, and the Code of Corporate Conduct in the Securities Listing Regulation. Instead, the Revised TOB disregards many of the core principles underpinning these frameworks, including:

- Lack of true majority-of-minority protection: The Company claims the Revised TOB satisfies a majority-of-minority standard because the Toyota Group companies – which are clearly interested parties in the transaction – have not entered into binding agreements to tender their shares. This claim is disingenuous. On the one hand, the Company claims that these Toyota affiliates are independent. On the other, it rejected a legally binding offer from a third party to purchase the Company’s cross-shareholding in one of these Toyota affiliates at a higher price on the basis that selling the stake would jeopardize the Revised TOB.7 Under the currently proposed majority-of-minority condition, only 42% of non-Toyota Group shareholders need to tender into the Revised TOB, which is meaningfully below a true majority-of-minority threshold (see Appendix 6).

- Financial advisors that lack independence: Mitsubishi UFJ Morgan Stanley Securities and SMBC Nikko Securities – financial advisors to the Special Committee and the Company, respectively – are affiliated with entities that are key lenders to the offeror group, creating a clear conflict of interest.

- Abuse of minority shareholders to benefit Toyota Group companies: Toyota Industries has over-invested in its automobile business for years, as evidenced by exceptionally high capital intensity compared to peers and a bloated nearly ¥1 trillion asset base in this division, combined with an unacceptable low-single-digit return on invested capital. While this business is critical to the operations of Toyota Motor Corporation, it does not serve the best interests of Toyota Industries’ shareholders.

The Standalone Plan for Toyota Industries

We have been discussing a standalone plan for the Company (the “Standalone Plan”) with members of the Company’s Board and Special Committee for several months. The Standalone Plan represents a clear alternative to the Revised TOB that will generate significantly more value for Toyota Industries’ shareholders. The Company holds the number-one global position in forklifts, with 28% market share, and has a world-class automation systems business with attractive growth prospects. Toyota Industries also has substantial financial assets, a strong balance sheet and significant opportunities for operational improvement.

Elliott sees a clear path for Toyota Industries to achieve a valuation of more than ¥40,000 per share by 2028 through the Standalone Plan. Key elements of the Standalone Plan include:

- Unwinding cross-shareholdings outside the context of any tender offer;

- Capturing the significant margin improvement opportunity in the business, through consolidation initiatives, product revitalisation and increased efficiency;

- Improving capital allocation by ceasing overinvestment in the automotive segment, which today predominantly serves the interests of Toyota Motor Corporation rather than Toyota Industries, as well as other initiatives; and

- Implementing governance reforms to ensure Toyota Industries operates for the benefit of its own shareholders rather than other Toyota Group stakeholders.

The choice for Toyota Industries’ shareholders is not between accepting ¥18,800 or receiving less. It is between accepting ¥18,800 today or retaining ownership in a strong business capable of delivering more than twice that value over the medium term. Elliott plans to release further details of the Standalone Plan in the near future.

Do Not Tender

Elliott has no intention of tendering its shares into the Revised TOB and we strongly encourage other shareholders not to tender.

Based on our analysis, the Revised TOB significantly undervalues the Company and is not in the best interests of shareholders. Toyota Industries’ recent trading price suggests the broader market agrees. With a clear path to unlocking value as a standalone company through operational improvements and more efficient capital allocation, there is no imperative to proceed with this transaction. As a supportive long-term shareholder, we believe the Company has immense value-creation potential.

Even absent the implementation of the Standalone Plan, we believe that the Toyota Industries share price would, in the near term, significantly increase above its current levels if the Revised TOB fails, because the share price has been materially anchored down by the Original and Revised TOBs ever since the June 3, 2025 pre-announcement.

The outcome of this tender offer depends on the decisions of genuinely independent shareholders. If a sufficient number decide not to tender, the offer will not succeed at this price. Independent shareholders have the opportunity to determine whether they receive fair value for their investment – either through meaningfully improved transaction terms or through the Company pursuing a standalone path.

The implications of this transaction are far-reaching. If the Revised TOB is allowed to succeed, it will result in a substantial and potentially irreversible setback for Japan’s corporate governance reforms and dampen investor interest in the Japanese market. As one of the largest and most important corporate groups in Japan, how the Toyota Group acts will set the tone for how both domestic and foreign investors view the Japanese market. Every shareholder has a voice in this transaction and can affect its outcome. We urge you to advocate for a better outcome for Toyota Industries and its shareholders by declining to tender your shares.

Sincerely,

Aaron Tai

Portfolio Manager

Gordon Singer

Managing Partner

DISCLAIMER

This document has been issued by Elliott Advisors (UK) Limited (“EAUK”), which is authorized and regulated by the United Kingdom’s Financial Conduct Authority (“FCA”), and Elliott Investment Management L.P. (“EIMLP”). Nothing within this document promotes, or is intended to promote, and may not be construed as promoting, any funds advised directly or indirectly by EAUK and EIMLP (the “Elliott Funds”).

This document is for discussion and informational purposes only. The views expressed herein represent the opinions of EAUK, EIMLP and their affiliates (collectively, “Elliott Management”) as of the date hereof. Elliott Management reserves the right to change or modify any of its opinions expressed herein at any time and for any reason and expressly disclaims any obligation to correct, update or revise the information contained herein or to otherwise provide any additional materials.

All of the information contained herein is based on publicly available information with respect to Toyota Industries Corporation (the “Company”), including public filings and disclosures made by the Company and other sources, as well as Elliott Management’s analysis of such publicly available information. Elliott Management has relied upon and assumed, without independent verification, the accuracy and completeness of all data and information available from public sources, and no representation or warranty is made that any such data or information is accurate. Elliott Management recognizes that there may be confidential or otherwise non-public information with respect to the Company that could alter the opinions of Elliott Management were such information known.

No representation, warranty or undertaking, express or implied, is given and no responsibility or liability or duty of care is or will be accepted by Elliott Management or any of its directors, officers, employees, agents, or advisors (each an “Elliott Person”) concerning: (i) this document and its contents, including whether the information and opinions contained herein are accurate, fair, complete or current; (ii) the provision of any further information, whether by way of update to the information and opinions contained in this document or otherwise to the recipient after the date of this document; or (iii) that Elliott Management’s investment processes or investment objectives will or are likely to be achieved or successful or that Elliott Management’s investments will make any profit or will not sustain losses. Past performance is not indicative of future results. To the fullest extent permitted by law, none of the Elliott Persons will be responsible for any losses, whether direct, indirect or consequential, including loss of profits, damages, costs, claims or expenses relating to or arising from the recipient’s or any person’s reliance on this document.

Except for the historical information contained herein, the information and opinions included in this document constitute forward-looking statements, including estimates and projections prepared with respect to, among other things, the Company’s anticipated operating performance, the value of the Company’s securities, debt or any related financial instruments that are based upon or relate to the value of securities of the Company (collectively, “Company Securities”), general economic and market conditions and other future events. You should be aware that all forward-looking statements, estimates and projections are inherently uncertain and subject to significant economic, competitive, and other uncertainties and contingencies and have been included solely for illustrative purposes. Actual results may differ materially from the information contained herein due to reasons that may or may not be foreseeable. There can be no assurance that the Company Securities will trade at the prices that may be implied herein, and there can be no assurance that any estimate, projection or assumption herein is, or will be proven, correct.

This document is for informational purposes only, and does not constitute (a) an offer or invitation to buy or sell, or a solicitation of an offer to buy or sell or to otherwise engage in any investment business or provide or receive any investment services in respect of, any security or other financial instrument and no legal relations shall be created by its issue, (b) a “financial promotion” for the purposes of the Financial Services and Markets Act 2000 of the U.K. (as amended), (c) “investment advice” as defined by the FCA’s Handbook of Rules and Guidance (“FCA Handbook”), (d) “investment research” as defined by the FCA Handbook, (e) an “investment recommendation” as defined by Regulation (EU) 596/2014 and by Regulation (EU) No. 596/2014 as it forms part of U.K. domestic law by virtue of section 3 of the European Union (Withdrawal) Act 2018 (“EUWA 2018”) including as amended by regulations issued under section 8 of EUWA 2018, (f) any action constituting “investment advisory business” as defined in Article 28, Paragraph 3, Item 1 of the Financial Instruments and Exchange Law of Japan (the “FIEL”), (g) any action constituting “investment management business” as defined in Article 28, Paragraph 4 of the FIEL, or (h) financial promotion, investment advice or an inducement or encouragement to participate in any product, offering or investment. No information contained herein should be construed as a recommendation by Elliott Management. This document is not intended to form the basis of any investment decision or as suggesting an investment strategy. This document is not (and may not be construed to be) legal, tax, investment, financial or other advice. Each recipient should consult their own legal counsel and tax and financial advisors as to legal and other matters concerning the information contained herein. This document does not purport to be all-inclusive or to contain all of the information that may be relevant to an evaluation of the Company, Company Securities or the matters described herein.

No agreement, commitment, understanding or other legal relationship exists or may be deemed to exist between or among Elliott Management and any other person by virtue of furnishing this document. Elliott Management is not acting for or on behalf of, and is not providing any advice or service to, any recipient of this document. Elliott Management is not responsible to any person for providing advice in relation to the subject matter of this document. Before determining on any course of action, any recipient should consider any associated risks and consequences and consult with its own independent advisors as it deems necessary.

The Elliott Funds may have a direct or indirect investment in the Company. Elliott Management therefore has a financial interest in the profitability of the Elliott Funds’ positions in the Company. Accordingly, Elliott Management may have conflicts of interest and this document should not be regarded as impartial. Nothing in this document should be taken as any indication of Elliott Management’s current or future trading or voting intentions which may change at any time. Elliott Management reserves the right to change its voting intention at any time notwithstanding any statements in this document.

Elliott Management intends to review its investments in the Company on a continuing basis and depending upon various factors, including without limitation, the Company’s financial position and strategic direction, the outcome of any discussions with the Company, overall market conditions, other investment opportunities available to Elliott Management, and the availability of Company Securities at prices that would make the purchase or sale of Company Securities desirable, Elliott Management may from time to time (in the open market or in private transactions, including since the inception of Elliott Management’s position) buy, sell, cover, hedge or otherwise change the form or substance of any of its investments (including Company Securities) to any degree in any manner permitted by law and expressly disclaims any obligation to notify others of any such changes. Elliott Management also reserves the right to take any actions with respect to its investments in the Company as it may deem appropriate.

Elliott Management has not sought or obtained consent from any third party to use any statements or information contained herein. Any such statements or information should not be viewed as indicating the support of such third party for the views expressed herein. All trademarks and trade names used herein are the exclusive property of their respective owners.

About Elliott

Elliott Investment Management L.P. (together with its affiliates, “Elliott”) manages approximately $76.1 billion of assets as of June 30, 2025. Founded in 1977, it is one of the oldest funds under continuous management. The Elliott funds’ investors include pension plans, sovereign wealth funds, endowments, foundations, funds-of-funds, high net worth individuals and families, and employees of the firm. Elliott Advisors (UK) Limited is an affiliate of Elliott Investment Management L.P.

Investor Contacts:

Okapi Partners LLC

New York: Pat McHugh

T:+1 212 297 0720

Toll Free: (877) 629-6357

London: Christian Jacques

T: +44 20 3031 6613

TICO@okapipartners.com

Media Contacts:

London

Stijn van de Grampel

Elliott Advisors (UK) Limited

T: +44 20 3009 1061

svdgrampel@elliottadvisors.co.uk

New York

Stephen Spruiell

Elliott Investment Management L.P.

T: +1 (212) 478-2017

sspruiell@elliottmgmt.com

Tokyo

Brett Wallbutton

Ashton Consulting

T: +81 (0) 3 5425-7220

b.wallbutton@ashton.jp

1 Based on Toyota Industries’ semi-annual report for the period ended September 30, 2025 and other public sources of information, we believe Elliott is the largest shareholder of Toyota Industries which is not affiliated with any Toyota Group companies.

2 The “Fair M&A Guidelines ― Enhancing Corporate Value and Securing Shareholders’ Interests” published by the Ministry of Economy, Trade and Industry dated June 28, 2019.

3 The “Guidelines for Corporate Takeovers – Enhancing Corporate Value and Securing Shareholders’Interests” published by the Ministry of Economy, Trade and Industry dated August 31, 2023.

4 The “Revisions to Securities Listing Regulations and Other Rules Pertaining to MBOs and Subsidiary Conversions” published by the Tokyo Stock Exchange dated July 7, 2025.

5 At a tax rate reflecting the benefits to Toyota Industries from its larger cross-shareholdings from the deemed dividend tax treatment under the issuer buyback unwind structure the Company plans to utilize.

6 Appendix 7 (The Process of Negotiations Before the Report) to the Toyota Industries Special Committee report dated January 14, 2026.

7 Page 35 of the Toyota Industries Special Committee report dated January 14, 2026.

Appendix 2: Revised TOB Terms Continue to Very Significantly Undervalue Toyota Industries (January 16, 2026) Source: Bloomberg, Company Materials

Appendix 3: Change in NAV per share between Pre-Announcement of Original TOB (June 3, 2025) and January 16, 2026 Source: Bloomberg, Company Materials

Appendix 4: The Revised TOB Price is Expected to be Below 1x PBR on FY3/26 Q3 Book Value Source: Bloomberg, Company Materials Notes: (1) Assumes Bloomberg consensus FY3/26 Q3 net profit; (2) FX impact is estimated based on the historical relationship between FX driven movements in the JPY book value (as disclosed in the statement of comprehensive income) vs. the FX rate movement in the quarter to December 31, 2025.

Appendix 5: Implied Valuation of the Operating Business of Toyota Industries Source: Bloomberg, Company Materials Notes: (1) Assumes cross-shareholding unwind at current market value (as of January 16, 2026); (2) Assumes the deemed dividend tax structure is enabled for qualifying cross-shareholdings through issuer buyback unwinds; (3) EBITDA after lease expenses.

Appendix 6: Current Minimum Acceptance Condition Does Not Satisfy True Majority-of-Minority Threshold Source: Company Materials Notes: (1) Share count as of September 30, 2025; (2) Total of Mr. Akio Toyoda, Toyota Fudosan, Aisin Corporation, Denso Corporation and Toyota Tsusho Corporation.